CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED (CIFCL)

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED

31st DECEMBER 2020

Total AUM crossed the milestone of ₹ 75,000 Crs Up by 15% and

Net Income Margin for the quarter – ₹ 1,364 Cr up by 26%

PAT for the quarter – ₹ 409 Cr up by 5%

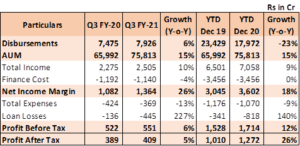

Key Financial results (Q3 FY21 & YTD Dec 2020):

- Total AUM up at ₹ 75,813 Cr (Up by 15% YoY)

- Net Income Margin at ₹ 1,364 Cr (Up 26% YoY) for Q3 FY21 and ₹ 3,602 Cr (Up 18% YoY) for YTD Dec 2020

- PAT at ₹ 409 Cr (Up 5% YoY) for Q3 FY21 and ₹ 1,272 Cr (Up 26% YoY) for YTD

Dec 2020

Chennai, January 29, 2021: The Board of Directors of CIFCL today approved the unaudited financial results for the quarter and nine months ended 31st December 2020.

Highlights:

Q3 and YTD December 2020 Performance:

Note: Loan Losses include additional COVID provisions of ₹ 216 Cr for the nine-month ended 31st December 2020, and total COVID provisions as of Dec 20 is 750crs

- Aggregate disbursements in Q3 FY 21 were at ₹ 7,926 Cr as against ₹ 7,475 in Q3 FY 20, with a growth of 6%. Disbursements for YTD Dec 2020 were at ₹ 17,972 Cr as against ₹ 23,429 Cr in the previous year registering a decline of 23% Y-on Y.

- Vehicle Finance (VF) business has clocked a volume of ₹ 6,084 Cr in Q3 FY 21 as against ₹ 5,949 in Q3 FY20, started registering growth of 2%. Disbursements for YTD Dec 2020, were at ₹ 14,096 Cr as against ₹ 18,685 Cr in the previous year, reporting a decline of 25% Y-o-Y.

- Loan Against Property (LAP) business disbursed ₹ 1,265 Cr in Q3 FY 21, as against ₹ 908 Cr in Q3 FY 20, with a good growth rate of 39%. The Disbursements for YTD De

- 2020 was ₹ 2,436 Cr as against ₹ 3,073 Cr in the previous year, registering a decline of 21% YoY.

- Home Loan (HL) business disbursed ₹ 434 Cr in Q3 FY 21, as against ₹ 400 Cr in Q3 FY 20 registering a growth of 8%. The Disbursements for the nine months ended Dec 2020 were at ₹ 1,004 Cr as against ₹ 1,234 Cr in the previous year, registering a decline of 32% YoY.

- Assets under management as at end of Dec 2020, grew by 15% at ₹ 75,813 Cr as compared to ₹ 65,992 Cr as at end of Dec 2019.

- Profits after Tax (PAT) for Q3 FY 21 were at ₹ 409 Cr compared to ₹ 389 Cr in Q3 FY 20, reporting a growth of 5%. PAT for the nine months ended 31st December 2020, were at ₹ 1,272 Cr as against ₹1,010 Cr in the same period last year registering a growth of 26%.

- PBT-ROA for Q3 FY 21 was at 3.1% as against 3.4% in previous year quarter, while for YTD Dec 2020 it was at 3.4%, which is at the same level of 3.4% for the nine months end Dec 2019.

- ROE for the YTD Dec 2020 was at 19.2% as against 20.3% in previous year.

- The Company continues to hold strong liquidity position with Rs. 6,228 Cr as cash balance as at end of Dec’20 (including Rs 1500 Cr invested in Gsec shown under investments, as it is held to maturity), with a total liquidity position of Rs.10,923 Cr (including undrawn sanctioned lines). The ALM is comfortable with no negative cumulative mismatches across all time buckets.

Interim Dividend:

The Board of Directors of the Company declared an Interim dividend of 65% being ₹ 1.30 per share on the equity shares of the Company, for the year ending March 31, 2021

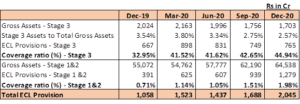

Asset Quality

CIFCL asset quality as at end of December 2020, represented by Stage 3 assets stood at 2.57% with a provision coverage of 44.94%, as against 3.54% as at end of December 2019 with a provision coverage of 32.95%. The company continues to carry additional provision of Rs. 751 crs for future contingencies as on 31st December 2020. The total provisions currently carried against the overall book is 3.09% as against the normal overall provision levels of 1.75% carried prior to the Covid-19 pandemic, representing an increase of above 75%.

Hon’ble Supreme Court has directed that accounts which were not in NPA as of 31st August 2020, shall not be declared as NPA till further orders. Accordingly, the Company has not classified any new accounts as NPA after 31st August 2020. However, if the Company had classified new accounts as NPA, then the Gross Stage 3 and Net Stage 3 would have been 3.75% and 2.12% respectively.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as on 31st December2020, was at 19.25% as against the regulatory requirement of 15%.

About Cholamandalam

Cholamandalam Investment and Finance Company Limited (Chola), incorporated in 1978 as the financial ser vices arm of the Murugappa Group. Chola commenced business as an equipment financing company and has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to cust omers.

Chola operates from 1135 branches across India with assets under management above INR 75,000 Crores.

The mission of Chola is to enable customers enter a better life. Chola has a growing clientele of over 16 lakh happy customers across the nation. Ever since its inception and all through its growth, the company has kept a clear sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all those who come within its corporate ambit – customers, shareholders, employees and society.

For more details, please visit www.cholamandalam.com

About Murugappa Group

Founded in 1900, the INR 381 Billion (38,105 Crores) Murugappa Group is one of India’s leading business con glomerates. The Group has 29 businesses including ten listed Companies traded in NSE & BSE. Head quartered in Chennai, the major Companies of the Group include Carborundum Universal Ltd., CG Power and Industrial Sol utions Ltd., Cholamandalam Financial Holdings Ltd., Cholamandalam Investment and Finance Company Ltd., Cholamandalam MS General Insurance Company Ltd., Coromandel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Parry (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd. and Wendt (India) Ltd.

Market leaders in served segments including Abrasives, Auto Components, Transmission systems, Cycles, Sugar, Farm Inputs, Fertilisers, Plantations, Bio-products and Nutraceuticals, the Group has forged strong alliances with leading international companies such as Groupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Advanced Materials, Sociedad Química y Minera de Chile (SQM), Yanmar & Co. and Compagnie Des Phosphat De Gafsa (CPG). The Group has a wide geographical presence all over India and spanning 6 continents.

Renowned brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi Gears and Paramfos are from the Murugappa stable. The Group fosters an environment of professionalism and has a workforce of over 51,000 employees.

For more details, visit www.murugappa.com