CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED (CIFCL)

AUDITED FINANCIAL RESULTS FOR THE QUARTER AND YEAR ENDED

31st MARCH 2021

PAT at Rs.243 Cr in Q4 – growth of 470% over Q4 of FY 20.

Full year PAT at Rs.1515 Cr – growth of 44%.

AUM crosses 76500 crs – up by 14%

Covid provisions of Rs 350 Crs in Q4 and total Covid provision of Rs.566 Cr in FY 21- Covid Provision carried end March 1100 crs.

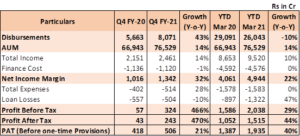

Key Financial results (Q4 FY21 & FY 20-21):

- Total AUM up at ₹ 76,529 Cr (Up by 14% YoY)

- Net Income Margin at ₹ 1,342 Cr (Up 32% YoY) for Q4 FY21 and ₹ 4,944 Cr (Up 22% YoY) for FY21

- PAT at ₹ 243 Cr (Up 470% YoY) for Q4 FY21 and ₹ 1,515 Cr (Up 44% YoY) for FY21

- Additional Covid Provision of Rs 350 crs created in Q4. Total Covid provision created in FY 21- Rs.566 crs. Total Covid Provision as of 31st March Rs,1100 crs

Chennai, May 07, 2021: The Board of Directors of CIFCL today approved the audited financial results for the quarter and year ended 31st March 2021.

Highlights:

Q4 and Full Year Performance:

Performance Highlights:

Note: Loan Losses include additional overlay of ₹ 350 crs created in Q4, and ₹ 566 Cr created during the year ended 31st March 2021. Cumulative additional overlay carried as of March 21 is ₹ 1100 crs.

- Aggregate disbursements in Q4 FY 21 were at ₹ 8,071 Cr as against ₹ 5,663 in Q4 FY 20, with a growth of 43%. Disbursements for the year ended March 21 were at ₹ 26,043 Cr as against ₹ 29,091 Cr in the previous year registering a decline of 10% Y-on Y. The decline in the full year number is primarily due to lower disbursements in Q1 and Q2 of FY 21 due to lock-down.

- Vehicle Finance (VF) business has clocked a volume of ₹ 6,153 Cr in Q4 FY 21 as against ₹ 4,703 in Q4 FY20, registering growth of 31%. Disbursements for the year ended March 21 were at ₹ 20,249 Cr as against ₹ 23,387 Cr in the previous year registering a decline of 13% Y-on Y.

- Loan Against Property (LAP) business disbursed ₹ 1,191 Cr in Q4 FY 21, as against ₹ 589 Cr in Q4 FY 20, clocking a growth of 102%. Disbursements for the year ended March 21 were at ₹ 3,627 Cr as against ₹ 3,662 Cr in the previous year registering a marginal decline of 1% Y-on Y.

- Home Loan (HL) business disbursed ₹ 538 Cr in Q4 FY 21, as against ₹ 271 Cr in Q4 FY 20 registering a growth of 99%. Disbursements for the year ended March 21 were at ₹ 1,542 Cr as against ₹ 1,505 Cr in the previous year started registering a growth of 2% Y-on Y.

- Assets under management as at end of March 2021, grew by 14% at ₹ 76,529 Cr as compared to ₹ 66,943 Cr as at end of March 2020.

- Profits after Tax (PAT) for Q4 FY 21 were at ₹ 243 Cr compared to ₹ 43 Cr in Q4 FY 20, reporting a growth of 470%. PAT for the year ended March 21, were at ₹ 1,515 Cr as against ₹1,052 Cr in the same period last year registering a growth of 44%.

- PBT-ROA for Q4 FY 21 was at 1.8% as against 0.4% in previous year quarter, while for the year ended March 2021 it was at 3.0%, compared to the immediate previous year of 2.7%. If we exclude one-time Provisions, the PBT-ROA would be 3.8% for Q4 FY 21 as against 3.7% for Q4 FY 20, and for the full year ended the ratio improvised to 3.8% for FY 21 compared to 3.5% for FY 20.

- ROE for the year ended March 21 was at 16.9% as against 15.2% in previous year. If we exclude one-time provisions the ROE would be 20.9% in FY 21 compared to 19.7% in FY 20.

- The Company continues to hold strong liquidity position with Rs. 6,428 Cr as cash balance as at end of Mar’21 (including Rs 1500 Cr invested in Gsec shown under investments) with a total liquidity position of Rs.9,780 Cr (including undrawn sanctioned lines). The ALM is comfortable with no negative cumulative mismatches across all time buckets.

Dividend:

The Board of Directors of the company has recommended a dividend of ₹ 0.70 per share (35%) on the equity shares of the company, subject to the approval of the shareholders of the company at the ensuing Annual General Meeting. This is in addition to the interim dividend of ₹ 1.30 per share (65%) for the financial year 2020-21 declared by the company on 29th January 2021.

Asset Quality

CIFCL asset quality as at end of March 2021, represented by Stage 3 assets stood at 3.96% with a provision cov erage of 44.27%, as against 3.80% as at end of March 2020 with a provision coverage of 41.52%. The company created additional provisions as management overlay for Rs.350 Cr towards future contingencies and thereby taking the overall management overlay to ₹ 1100 Crs as on 31st March 2021. The total provisions currently car ried against the overall book is 3.58% as against the normal overall provision levels of 1.75% carried prior to the Covid-19 pandemic, representing two times than normal provision coverage.

Note: In order to facilitate comparative trend, the Stage 3 numbers, mentioned in the above table is based on actual delinquency status at each point in time and has not factored in the process of not declaring overdue as sets as NPA as directed by the SC, since this interim order has been vacated in March 21.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as on 31st March 2021, was at 19.07% as against the regula tory requirement of 15%.

Others:

During the quarter the company has invested in Vishwakarma Payments Pvt Limited, a consortium of entities, and jointly applied for a NUE (New Umbrella Entity) licence for Retail payments with RBI.

About Cholamandalam

Cholamandalam Investment and Finance Company Limited (Chola), incorporated in 1978 as the financial servi c esarm of the Murugappa Group. Chola commenced business as an equipment financing company and has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to customers.

Chola operates from 1137 branches across India with assets under management above INR 76,000 Crores.

The mission of Chola is to enable customers enter a better life. Chola has a growing clientele of over 16 lakh ha ppy customers across the nation. Ever since its inception and all through its growth, the company has kept a cle ar sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all tho se who come within its corporate ambit – customers, shareholders, employees and society.

For more details, please visit www.cholamandalam.com

About Murugappa Group

Founded in 1900, the INR 381 Billion (38,105 Crores) Murugappa Group is one of India’s leading business cong lomerates. The Group has 29 businesses including ten listed Companies traded in NSE & BSE. Headquartered in Chennai, the major Companies of the Group include Carborundum Universal Ltd., CG Power and Industrial Sol utions Ltd., Cholamandalam Financial Holdings Ltd., Cholamandalam Investment and Finance Company Ltd., Cho lamandalam MS General Insurance Company Ltd., Coromandel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Parry (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd. and Wendt (India) Ltd.

Market leaders in served segments including Abrasives, Auto Components, Transmission systems, Cycles, Sugar, Farm Inputs, Fertilisers, Plantations, Bio-products and Nutraceuticals, the Group has forged strong alliances wi th leading international companies such as Groupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Adva nced Materials, Sociedad Química y Minera de Chile (SQM), Yanmar & Co. and Compagnie Des Phosphat De Gaf sa (CPG). The Group has a wide geographical presence all over India and spanning 6 continents.

Renowned brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi Gea rs and Paramfos are from the Murugappa stable. The Group fosters an environment of professionalism and has a workforce of over 51,000 employees.

For more details, visit www.murugappa.com