Indiabulls Housing Finance Limited announces Public Issue of Secured Redeemable Non-Convertible Debentures (NCDs)

Tranche I Issue to Open on December 09; Effective Yield up to 9.26% p.a.*The Tranche I NCD issue includes a Base Issue Size of Rs.200 crores with an option to retain oversubscription up to Rs 800 crore aggregating up to Rs. 1,000 crores

- Rated as CRISIL AA/Stable by Crisil Ratings Limited and BWR AA+/Stable by Brickwork Ratings India Private Limited

- Effective annualized yield up to 9.26% p.a#.

- The Tranche I Issue opens on December 09, 2021 and closes on December 20, 2021*

- Trading in dematerialized form only

- Allotment on date priority basis i.e. on first -come- first-serve-basis, based on the date of upload of each application into the electronic system of the Stock Exchange, in each Portion subject to the Allocation Ratio.

- The NCDs are proposed to be listed on BSE Limited and National Stock Exchange of India Limited (collectively, the “Stock Exchanges”).

Chennai, December 08, 2021: Indiabulls Housing Finance Limited, a housing finance company regulated by National Housing Bank, has announced the issue of secured, redeemable, non-convertible debentures of the face value of Rs. 1,000 each. The Issue opens on December 09, 2021 and closes on December 20, 2021 with an option of early closure.

The Issue has a base issue size of Rs. 200 crores with an option to retain oversubscription up to Rs 800 crores, aggregating up to Rs. 1,000 crores. The NCDs are proposed to be listed on the Stock Exchanges with BSE Limited as the Designated Stock Exchange for the Issue. The NCDs have been rated CRISIL AA/Stable by CRISIL Ratings Limited and BWR AA+ (pronounced as Brickwork double A plus rating with stable outlook) by Brickworks Ratings India Private Limited.

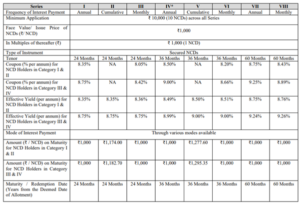

The NCDs issued pursuant to the Issue have a tenure of 24 months, 36 months, and 60 months. Effective yield (per annum) for NCD holders in Category I (Institutional Investors) & Category II (Non-Institutional Investors) ranges from 8.35% to 8.76% and for NCD holders in Category III (HNI Investors) and Category IV (Retail Individual Investors) ranges from 8.75% to 9.26%. Frequency of Interest payments are Annually, Monthly or Cumulative as per the choice of investors. Amount on maturity for NCD holders in Category I (Institutional Investors) & Category II (Non-Institutional Investors) ranges from Rs 1,174.00 to Rs 1277.60 per NCD for Series II and Series V respectively and for Category III (HNI Investors) and Category IV (Retail Individual Investor) ranges from Rs 1,182.70 to Rs 1295.35 per NCD for Series II and Series V respectively.

Net proceeds of the Issue will be utilized for the purpose of onward lending, financing, and for repayment of principal and interest of existing borrowings of the Company (at least 75%) – and the rest (up to 25%) for general corporate purposes.

As per its Limited Review Financial Results for the six months ended September 30, 2021, IBHFL’s CRAR (capital adequacy ratio) stood at 21.68% on a standalone basis. The terms of each series of NCDs, offered under Tranche I Issue are set out below:

The Lead Managers to the issue are Edelweiss Financial Services Limited, IIFL Securities Limited and Trust Investment Advisors Private Limited.

# For further details please refer Shelf Prospectus dated December 3, 2021 and Tranche I Prospectus dated December 3, 2021

*Tranche I Issue may close on such earlier date or extended date as may be decided by the Board of Directors of our Company or Securities Issuance Committee thereof. In the event of an early closure or extension of the Tranche I Issue; our Company shall ensure that notice of the same is provided to the prospective investors through an advertisement on or before such earlier or extended date of Tranche I Issue Closure in which pre-issue advertisement and advertisement for opening or closure of the Tranche I Issue have been given.

DISCLAIMER:

DISCLAIMER CLAUSE OF BSE: BSE LIMITED DOES NOT IN ANY MANNER:

- WARRANT, CERTIFY OR ENDORSE THE CORRECTNESS OR COMPLETENESS OF ANY OF THE CONTENTS OF THIS OFFER DOCUMENT; OR

- WARRANT THAT THIS COMPANY’S SECURITIES WILL BE LISTED OR WILL CONTINUE TO BE LISTED ON THE EXCHANGE; OR

- TAKE ANY RESPONSIBILITY FOR THE FINANCIAL OR OTHER SOUNDNESS OF THIS COMPANY, ITS PROMOTER, ITS MANAGEMENT OR ANY SCHEME OR PROJECT OF THIS COMPANY;

AND IT SHOULD NOT FOR ANY REASON BE DEEMED OR CONSTRUED THAT THIS OFFER DOCUMENT HAS BEEN CLEARED OR APPROVED BY THE EXCHANGE. EVERY PERSON WHO DESIRES TO APPLY FOR OR OTHERWISE ACQUIRES ANY SECURITIES OF THIS COMPANY MAY DO SO PURSUANT TO INDEPENDENT INQUIRY, INVESTIGATION AND ANALYSIS AND SHALL NOT HAVE ANY CLAIM AGAINST THE EXCHANGE WHATSOEVER BY REASON OF ANY LOSS WHICH MAY BE SUFFERED BY SUCH PERSON CONSEQUENT TO OR IN CONNECTION WITH SUCH SUBSCRIPTION/ACQUISITION WHETHER BY REASON OF ANYTHING STATED OR OMITTED TO BE STATED HEREIN OR FOR ANY OTHER REASON WHATSOEVER.

DISCLAIMER CLAUSE OF NSE: IT IS TO BE DISTINCTLY UNDERSTOOD THAT THE AFORESAID PERMISSION GIVEN BY NSE SHOULD NOT IN ANY WAY BE DEEMED OR CONSTRUED THAT THE OFFER DOCUMENT HAS BEEN CLEARED OR APPROVED BY NSE; NOR DOES IT IN ANY MANNER WARRANT, CERTIFY OR ENDORSE THE CORRECTNESS OR COMPLETENESS OF ANY OF THE CONTENTS OF THIS OFFER DOCUMENT; NOR DOES IT WARRANT THAT THIS ISSUER’S SECURITIES WILL BE LISTED OR WILL CONTINUE TO BE LISTED ON THE EXCHANGE; NOR DOES IT TAKE ANY RESPONSIBILITY FOR THE FINANCIAL OR OTHER SOUNDNESS OF THIS ISSUER, ITS PROMOTER, ITS MANAGEMENT OR ANY SCHEME OR PROJECT OF THIS ISSUER.

EVERY PERSON WHO DESIRES TO APPLY FOR OR OTHERWISE ACQUIRE ANY SECURITIES OF THIS ISSUER MAY DO SO PURSUANT TO INDEPENDENT INQUIRY, INVESTIGATION AND ANALYSIS AND SHALL NOT HAVE ANY CLAIM AGAINST THE EXCHANGE WHATSOEVER BY REASON OF ANY LOSS WHICH MAY BE SUFFERED BY SUCH PERSON CONSEQUENT TO OR IN CONNECTION WITH SUCH SUBSCRIPTION/ACQUISITION WHETHER BY REASON OF ANYTHING STATED OR OMITTED TO BE STATED HEREIN OR ANY OTHER REASON WHATSOEVER.

EVERY PERSON WHO DESIRES TO APPLY FOR OR OTHERWISE ACQUIRE ANY SECURITIES OF THIS ISSUER MAY DO SO PURSUANT TO INDEPENDENT INQUIRY, INVESTIGATION AND ANALYSIS AND SHALL NOT HAVE ANY CLAIM AGAINST THE EXCHANGE WHATSOEVER BY REASON OF ANY LOSS WHICH MAY BE SUFFERED BY SUCH PERSON CONSEQUENT TO OR IN CONNECTION WITH SUCH SUBSCRIPTION/ACQUISITION WHETHER BY REASON OF ANYTHING STATED OR OMITTED TO BE STATED HEREIN OR ANY OTHER REASON WHATSOEVER.

DISCLAIMER CLAUSE OF NHB: THE COMPANY HAS OBTAINED A CERTIFICATE OF REGISTRATION DATED DECEMBER 28, 2005 ISSUED BY THE NATIONAL HOUSING BANK UNDER SECTION 29A OF THE NATIONAL HOUSING BANK ACT, 1987. HOWEVER, A COPY OF THE SHELF PROSPECTUS OR THE TRANCHE 1 PROSPECTUS HAS NOT BEEN FILED WITH OR SUBMITTED TO THE NHB. IT IS DISTINCTLY UNDERSTOOD THAT THE DRAFT SHELF PROSPECTUS, THE SHELF PROSPECTUS AND THE TRANCHE I PROSPECTUS SHOULD NOT IN ANY WAY BE DEEMED OR CONSTRUED TO BE APPROVED OR VETTED BY THE NHB. THE NHB DOES NOT ACCEPT ANY RESPONSIBILITY OR GUARANTEE ABOUT THE PRESENT POSITION AS TO THE FINANCIAL SOUNDNESS OF THE ISSUER OR FOR THE CORRECTNESS OF ANY OF THE STATEMENTS OR REPRESENTATIONS MADE OR OPINIONS EXPRESSED BY THE ISSUER AND FOR DISCHARGE OF LIABILITY BY THE ISSUER. BY ISSUING THE AFORESAID CERTIFICATE OF REGISTRATION DATED DECEMBER 28, 2005 TO THE ISSUER, THE NHB NEITHER ACCEPTS ANY RESPONSIBILITY NOR GUARANTEE FOR THE PAYMENT OF ANY AMOUNT DUE TO ANY INVESTOR IN RESPECT OF THE PROPOSED NCDS ISSUE

DISCLAIMER CLAUSE OF BRICKWORK: BWR WISHES TO INFORM ALL PERSONS WHO MAY COME ACROSS RATING RATIONALES AND RATING REPORTS PROVIDED BY BWR THAT THE RATINGS ASSIGNED BY BWR ARE BASED ON INFORMATION OBTAINED FROM THE ISSUER OF THE INSTRUMENT AND OTHER RELIABLE SOURCES, WHICH IN BWR’S BEST JUDGEMENT ARE CONSIDERED RELIABLE. THE RATING RATIONALE / RATING REPORT &OTHER RATING COMMUNICATIONS ARE INTENDED FOR THE JURISDICTION OF INDIA ONLY. THE REPORTS SHOULD NOT BE THE SOLE OR PRIMARY BASIS FOR ANY INVESTMENT DECISION WITHIN THE MEANING OF ANY LAW OR REGULATION (INCLUDING THE LAWS AND REGULATIONS APPLICABLE IN EUROPE AND ALSO THE USA).

BWR ALSO WISHES TO INFORM THAT ACCESS OR USE OF THE SAID DOCUMENTS DOES NOT CREATE A CLIENT RELATIONSHIP BETWEEN THE USER AND BWR. THE RATINGS ASSIGNED BY BWR ARE ONLY AN EXPRESSION OF BWR’S OPINION ON THE ENTITY / INSTRUMENT AND SHOULD NOT IN ANY MANNER BE CONSTRUED AS BEING A RECOMMENDATION TO EITHER, PURCHASE, HOLD OR SELL THE INSTRUMENT. BWR ALSO WISHES TO ABUNDANTLY CLARIFY THAT THESE RATINGS ARE NOT TO BE CONSIDERED AS AN INVESTMENT ADVICE IN ANY JURISDICTION NOR ARE THEY TO BE USED AS A BASIS FOR OR AS AN ALTERNATIVE TO INDEPENDENT FINANCIAL ADVICE AND JUDGEMENT OBTAINED FROM THE USER’S FINANCIAL ADVISORS. BWR SHALL NOT BE LIABLE TO ANY LOSSES INCURRED BY THE USERS OF THESE RATING RATIONALES, RATING REPORTS OR ITS CONTENTS. BWR RESERVES THE RIGHT TO VARY, MODIFY, SUSPEND OR WITHDRAW THE RATINGS AT ANY TIME WITHOUT ASSIGNING REASONS FOR THE SAME. BWR’S RATINGS REFLECT BWR’S OPINION ON THE DAY THE RATINGS ARE PUBLISHED AND ARE NOT REFLECTIVE OF FACTUAL CIRCUMSTANCES THAT MAY HAVE ARISEN ON A LATER DATE. BWR IS NOT OBLIGED TO UPDATE ITS OPINION BASED ON ANY PUBLIC NOTIFICATION, IN ANY FORM OR FORMAT ALTHOUGH BWR MAY DISSEMINATE ITS OPINION AND ANALYSIS WHEN DEEMED FIT.

NEITHER BWR NOR ITS AFFILIATES, THIRD PARTY PROVIDERS, AS WELL AS THE DIRECTORS, OFFICERS, SHAREHOLDERS, EMPLOYEES OR AGENTS (COLLECTIVELY, “BWR PARTY”) GUARANTEE THE ACCURACY, COMPLETENESS OR ADEQUACY OF THE RATINGS, AND NO BWR PARTY SHALL HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN, REGARDLESS OF THE CAUSE, OR FOR THE RESULTS OBTAINED FROM THE USE OF ANY PART OF THE RATING RATIONALES OR RATING REPORTS. EACH BWR PARTY DISCLAIMS ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. IN NO EVENT SHALL ANY BWR PARTY BE LIABLE TO ANY ONE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING, WITHOUT LIMITATION, LOST INCOME OR LOST PROFITS AND OPPORTUNITY COSTS) IN CONNECTION WITH ANY USE OF ANY PART OF THE RATING RATIONALES AND/OR RATING REPORTS EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. HOWEVER, BWR OR ITS ASSOCIATES MAY HAVE OTHER COMMERCIAL TRANSACTIONS WITH THE COMPANY/ENTITY. BWR AND ITS AFFILIATES DO NOT ACT AS A FIDUCIARY. BWR KEEPS CERTAIN ACTIVITIES OF ITS BUSINESS UNITS SEPARATE FROM EACH OTHER IN ORDER TO PRESERVE THE INDEPENDENCE AND OBJECTIVITY OF THE RESPECTIVE ACTIVITY. AS A RESULT, CERTAIN BUSINESS UNITS OF BWR MAY HAVE INFORMATION THAT IS NOT AVAILABLE TO OTHER BWR BUSINESS UNITS. BWR HAS ESTABLISHED POLICIES AND PROCEDURES TO MAINTAIN THE CONFIDENTIALITY OF CERTAIN NON-PUBLIC INFORMATION RECEIVED IN CONNECTION WITH EACH ANALYTICAL PROCESS.

BWR CLARIFIES THAT IT MAY HAVE BEEN PAID A FEE BY THE ISSUERS OR UNDERWRITERS OF THE INSTRUMENTS, FACILITIES, SECURITIES ETC., OR FROM OBLIGORS. BWR’S PUBLIC RATINGS AND ANALYSIS ARE MADE AVAILABLE ON ITS WEB SITE, WWW.BRICKWORKRATINGS.COM. MORE DETAILED INFORMATION MAY BE PROVIDED FOR A FEE. BWR’S RATING CRITERIA ARE ALSO GENERALLY MADE AVAILABLE WITHOUT CHARGE ON BWR’S WEBSITE. THIS DISCLAIMER FORMS AN INTEGRAL PART OF THE RATINGS RATIONALES / RATING REPORTS OR OTHER PRESS RELEASES, ADVISORIES, COMMUNICATIONS ISSUED BY BWR AND CIRCULATION OF THE RATINGS WITHOUT THIS DISCLAIMER IS PROHIBITED. BWR IS BOUND BY THE CODE OF CONDUCT FOR CREDIT RATING AGENCIES ISSUED BY THE SECURITIES AND EXCHANGE BOARD OF INDIA AND IS GOVERNED BY THE APPLICABLE REGULATIONS ISSUED BY THE SECURITIES AND EXCHANGE BOARD OF INDIA AS AMENDED FROM TIME TO TIME.

DISCLAIMER CLAUSE OF CRISIL RATINGS: CRISIL RESEARCH, A DIVISION OF CRISIL LIMITED (CRISIL) HAS TAKEN DUE CARE AND CAUTION IN PREPARING THIS REPORT (REPORT) BASED ON THE INFORMATION OBTAINED BY CRISIL FROM SOURCES WHICH IT CONSIDERS RELIABLE (DATA). HOWEVER, CRISIL DOES NOT GUARANTEE THE ACCURACY, ADEQUACY OR COMPLETENESS OF THE DATA / REPORT AND IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS OR FOR THE RESULTS OBTAINED FROM THE USE OF DATA / REPORT. THIS REPORT IS NOT A RECOMMENDATION TO INVEST / DISINVEST IN ANY ENTITY COVERED IN THE REPORT AND NO PART OF THIS REPORT SHOULD BE CONSTRUED AS AN EXPERT ADVICE OR INVESTMENT ADVICE OR ANY FORM OF INVESTMENT BANKING WITHIN THE MEANING OF ANY LAW OR REGULATION. CRISIL ESPECIALLY STATES THAT IT HAS NO LIABILITY WHATSOEVER TO THE SUBSCRIBERS / USERS / TRANSMITTERS/ DISTRIBUTORS OF THIS REPORT. WITHOUT LIMITING THE GENERALITY OF THE FOREGOING, NOTHING IN THE REPORT IS TO BE CONSTRUED AS CRISIL PROVIDING OR INTENDING TO PROVIDE ANY SERVICES IN JURISDICTIONS WHERE CRISIL DOES NOT HAVE THE NECESSARY PERMISSION AND/OR REGISTRATION TO CARRY OUT ITS BUSINESS ACTIVITIES IN THIS REGARD. INDIABULLS HOUSING FINANCE LIMITED WILL BE RESPONSIBLE FOR ENSURING COMPLIANCES AND CONSEQUENCES OF NON-COMPLAINCES FOR USE OF THE REPORT OR PART THEREOF OUTSIDE INDIA. CRISIL RESEARCH OPERATES INDEPENDENTLY OF, AND DOES NOT HAVE ACCESS TO INFORMATION OBTAINED BY CRISIL RATINGS LIMITED / CRISIL RISK AND INFRASTRUCTURE SOLUTIONS LTD (CRIS), WHICH MAY, IN THEIR REGULAR OPERATIONS, OBTAIN INFORMATION OF A CONFIDENTIAL NATURE. THE VIEWS EXPRESSED IN THIS REPORT ARE THAT OF CRISIL RESEARCH AND NOT OF CRISIL RATINGS LIMITED / CRIS. NO PART OF THIS REPORT MAY BE PUBLISHED/REPRODUCED IN ANY FORM WITHOUT CRISIL’S PRIOR WRITTEN APPROVAL.

About Indiabulls Housing Finance Limited:

Indiabulls Housing Finance Limited, is one of the largest housing finance companies in India in terms of AUM. It focuses primarily on long term secured mortgage backed loans. Majority of its loan book comprises of secured loans. Indiabulls Housing Finance Limited primarily offers housing loans and loans against property to salaried and self-employed individuals and micro, small and medium sized enterprises and corporates. It has shifted to an asset light business model, focusing on co-lending of loans along with banks, other financial institutions and credit funds. As on September 30, 2021 it had a network of 135 offices spread across 92 cities.