CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED (CIFCL)

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED

31st DECEMBER 2021

Key Financial results (Q3 & YTD Dec 2021):

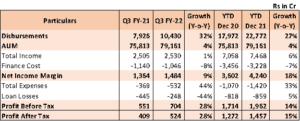

- Disbursements at ₹ 10,430 Cr for the quarter (Up by 32%) and ₹ 22,772 Cr for YTD Dec 2021 (Up by 27% YoY)

- Total AUM at ₹ 79,161 Cr (Up by 4% YoY)

- Net Income Margin up at ₹ 1,484 Cr for the quarter (Up 9% YoY) and ₹ 4,240 Cr for YTD Dec 2021 (Up 18% YoY)

- PAT at ₹ 524 Cr for the quarter (Up 28% YoY) and ₹ 1,457 Cr for YTD Dec 2021 (Up by 15% YoY)

Chennai, February 1, 2022: The Board of Directors of CIFCL today announced the unaudited financial results for the quarter and nine months ended 31st December 2021.

Highlights:

Post the second wave of COVID pandemic, economic activities have been steadily improving, including for contact-intensive service industries that were hit hard by the pandemic. Pent-up demand and good monsoon have further aided to the swift revival of India’s economy in Q3 of FY2022. Uptrend in economic indicators like tax collections, power consumptions, vehicle registrations, highway toll collections and e-way bills points towards a broad-based economic revival. This has led to a sharp recovery in Chola’s disbursements and collections during Q3 FY22. The positive momentum seen in Q2 FY22 further accelerated during Q3 FY 2022 on account of healthy demand during festive seasons boosting auto sales and improved consumer sentiments leading to healthy demand for mortgage loans.

New Business Division, Digital Partnership:

During the quarter, the Company has launched the following three new business divisions in the Consumer and SME eco‐system namely:

- Consumer & Small Enterprise Loan: – This division will offer Personal & Professional Loans and Micro & Small Enterprise Loan through traditional, direct to customer and digital partnership channels. The company entered into strategic partnerships with 3 leading Fintech companies – Bankbazaar, Kreditbee and Paytail to scale up this business vertical.

- Secured Business & Personal Loan: – This division will offer loans to self-employed non-professionals through traditional channel for their day-to-day operations and capital investments.

- SME Loan: – This division will offer term loans, working capital finance, equipment finance and supply chain finance to SME customers through traditional and digital partnership channels.

Equity Investment in Payswiff:

The Company has executed an arrangement to make a strategic investment in the equity shares of Payswiff Technologies Private Limited (Payswiff) up to a sum not exceeding Rs.450 crores. This will result in the Company holding about 72% of the equity capital of Payswiff on a fully diluted basis and Payswiff consequently will become a subsidiary of the Company.

Payswiff is engaged in the business of enabling online payment gateway services for e-commerce businesses and provides e-commerce solutions. Payswiff is an omni channel payment transaction solution provider that lets business owners accept payments from their customers in-store, at home deliveries, online, and on-the-go using their product offerings.This relationship is expected to add value to the existing Chola ecosystem by providing a platform to build new-age SME offering at scale, access to the SME network across the country and an opportunity to be one of the preferred SME financiers.

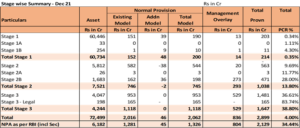

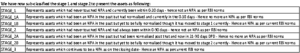

Changes to RBI regulation on Asset Classification and Provisioning under IRAC:

RBI had made changes to the method of evaluating the NPAs as per their circular dated 12th Nov 2021.Basis this, the following are the key changes brought into scope with immediate effect:

- NPA evaluation should be on day basis based on daily DPD run after end of the day process in the system.

- Agreements which cross 90 days DPD, should continue to be classified as NPA until all dues towards principal and interest are completed

While these changes are regarding evaluation of NPA as per Income Recognition and Asset Classification and Provisioning (IRACP) as defined by RBI, and has no bearing directly on the ECL model, we have made suitable changes in presenting the stagewise asset categorization to bring in more transparency in our reporting to enable all stakeholders to relate the figures both under IRAC model and the IND AS ECL model. Accordingly, we have sub-categorised the stages as follows:

During the quarter the company has made additional provisions of Rs 136 crs towards management overlay taking the total management overlay to 836 crs.

Performance Highlights:

- Aggregate disbursements in Q3 FY 22 were at ₹ 10,430 Cr as against ₹ 7,926 Cr in Q3 FY 21 with a growth of 32%. Disbursements for YTD Dec 2021 were at ₹ 22,772 Cr as against ₹ 17,972 Cr in the previous year registering the growth of 27% Y-on-Y.

- Vehicle Finance (VF) disbursements were at ₹ 7,647 Cr in Q3 FY 22 as against ₹ 6,084 Cr in Q3 FY21, growth of 26%. Disbursements for YTD Dec 2021, were at ₹ 16,654 Cr as against ₹ 14,096 Cr in the previous year, reporting a growth of 18% Y-o-Y.

- Loan Against Property (LAP) business disbursed ₹ 1,763 Cr in Q3 FY 22, as against ₹ 1,265 Cr in Q3 FY 21, with a growth rate of 39%. The Disbursements for YTD Dec 2021 were at ₹ 3,884 Cr as against ₹ 2,436 Cr in the previous year, registering a good growth rate of 59% Y-o-Y.

- Home Loan (HL) business disbursed ₹ 437 Cr in Q3 FY 22, as against ₹ 434 Cr in Q3 FY 21. The Disbursements for YTD Dec 2021 were at ₹ 1,129 Cr as against ₹ 1,004 Cr in the previous year, registering a growth of 12% Y-o-Y.

- Assets under management as of 31st Dec 2021, stood at ₹ 79,161 Cr as compared to ₹ 75,813 Cr as of end Dec in FY21.

- Profits after Tax (PAT) for Q3 FY 22 were at ₹ 524 Cr compared to ₹ 409 Cr in Q3 FY 21, reporting a growth of 28%. PAT for YTD Dec 2021, were at ₹ 1,457 Cr as against ₹ 1,272 Cr in the same period last year registering a growth of 15%.

- PBT-ROA for Q3 FY 22 was at 3.8% and for YTD Dec 2021 was at 3.6% as against 3.1% and 3.4% respectively in the same period last year.

- ROE for Q3 FY 22 was at 19.3% as against 17.6% in previous year.

- The Company continues to hold a strong liquidity position with ₹ 6,317.50 Cr as cash balance as at end of December 21 (including Rs 1500 Cr invested in Gsec shown under investments), with a total liquidity position of ₹ 10,671 Cr (including undrawn sanctioned lines). The ALM is comfortable with no negative cumulative mismatches across all time buckets.

Interim Dividend

The Board of Directors of the Company approved the payment of Interim dividend of 65% being ₹ 1.30 per share on the equity shares of the Company, for the year ending March 31, 2022.

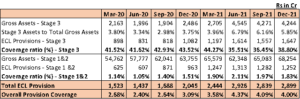

Asset Quality

CIFCL asset quality as at end of December 2021, represented by Stage 3 assets stood at 5.85% with a provision coverage of 38.80%, as against 6.16% as at end of September 2021 with a provision coverage of 36.45%. The total provisions currently carried against the overall book is 4.00% as against the normal overall provision levels of 1.75% carried prior to the Covid-19 pandemic, representing more than twice the normal pre-covid provision coverage level.

As per revised RBI norms (circular dated Nov 12th, 2021) GNPA% and NNPA% as of December’21 is at 8.53% and 5.76% respectively. We carry Rs.746 Cr higher provisions under INDAS over IRAC.

Note: Sep-20 and Dec-20 numbers are before considering Supreme Court Interim orders, which had directed the accounts which were not declared NPA till 31-Aug-2020 shall not be declared as NPA till further orders. This is done to facilitate comparative numbers. The interim order granted stands vacated on March 23 and hence co mpany has continued with the asset classification as per ECL model under INDAS for the quarter and year ended 31st March 2021.Considering the Supreme Court Interim orders directions Stage 3 % for Sep-20 and Dec-20 wor ks out to 2.75% and 2.57% respectively.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as on 31st December 2021, was at 19.8% as against the regulatory requirement of 15%. Tier-I Capital was at 16.8%.

About Cholamandalam

Cholamandalam Investment and Finance Company Limited (Cho la), incorporated in 1978 as the financial servic es arm of the Mur ugappa Group. Chola commenced business as an equipment fin ancing company and has today emerged as a comprehensive fin ancial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to customers.

Chola operates from 1142 branches across India with assets under management above INR 79,000 Crores.

The mission of Chola is to enable customers enter a better life. Chola has a growing clientele of over 16 lakh happy customers across the nation. Ever since its inception and all through its growth, the company has kept a clear sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all those who come within its corporate ambit – customers, shareholders, employees and society.

For more details, please visit www.cholamandalam.com

About Murugappa Group

Founded in 1900, the INR 417 Billion (41,713 Crores) Murugappa Group is one of India’s leading business cong omerates. The Group has 29 businesses including ten listed Companies traded in NSE & BSE. Headquartered in Chennai, the major Companies of the Grou p include Carborundum Universal Ltd., CG Power and Industrial Solu tions Ltd., Cholamandalam Financial Holdings Ltd., Cholama ndalam Investment and Finance Company Ltd., Ch olamandalam MS General Insurance Company Ltd., Corom andel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Parry (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd. and Wendt (India) Ltd.

The Group holds leadership position in several product lines including Abrasives, Technical Ceramics, Electro Min erals, Auto Components & Systems, Bicycles, Fertilisers, Sugar, Tea and Spirulina (Nutraceuticals). The Gro up has forged strong alliances with leading international companies such as Groupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Advanced Materials, Yanmar & Co. and Compagnie Des Phosphat De Gafsa (CPG). Th e Group has a wide geographical presence all over India and spanning 6 continents.

Renowned brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi Ge ars and Paramfos are from the Murugappa stable. The Group fosters an environment of professionalism and has a workforce of over 53,000 employees.

For more details, visit https://www.murugappa.com