Dr Mehta’s advanced cardiac care centre which included a Cathlab and cardiac ICU with state-of-the-art OT was launched

Financial Inclusion and the role of Microfinance in enabling holistic economic development

Chennai, February 22, 2023

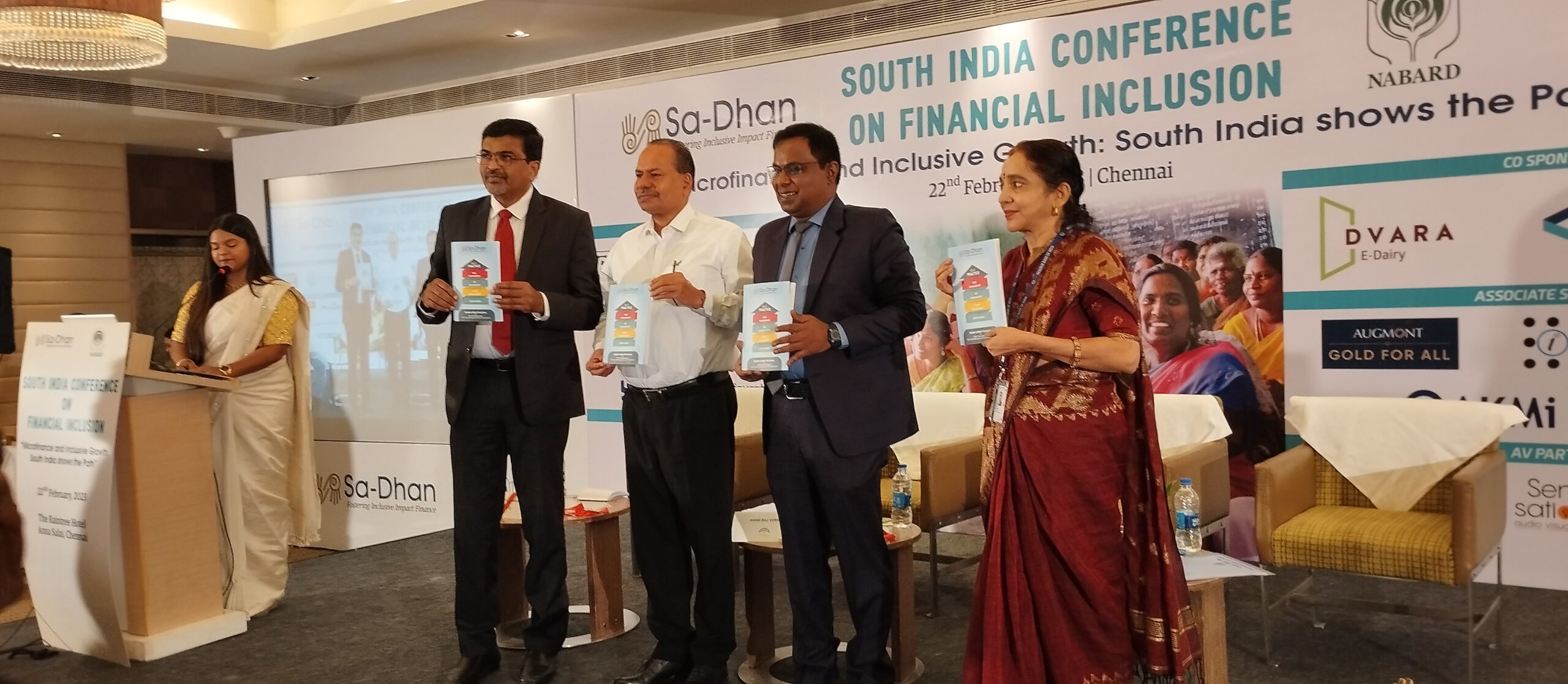

Sa-Dhan an association of impact finance institutions, which includes microfinance institutions, and an SRO app ointed by RBI for the microfinance sector is organising the ‘South India Conference on Financial Inclusion in Ch ennai, a regional level conference, for the first time. The daylong conference will focus on financial inclusion achi eved in Southern states of India, basically by extending credit to unserved and underserved population through microfinance, in south India.

Speaking about the conference, Jiji Mammen, ED & CEO, Sa-Dhan, said, “South India leads the rest of the coun tr y in financial inclusion. The success of microfinance in south India has contributed significantly to this. Be it the Self-Help Affinity Groups promoted by MYRADA in the 1980s, which evolved into the SHG bank linkage progra mme, or the demonstration of the scale-up potential of lending to Joint Liability Groups by specialized instituti ons called MFIs, it has been the states of southern India that have shown the path.” He further added, “South Ind ia, therefore, has valuable lessons for the real financial inclusion. These emerge both from the successes as well as the problems that the sector has encountered. This conference will aim at disseminating these lessons to a wi der microfinance audience in India and the world.”

Policymakers, regulators and industry stalwarts will share their perspectives on the sector. The policy frame work introduced last year by the Reserve Bank of India has set in place a cohesive rule for the microfinance in dustry.

RBI has enabled the microfinance industry to grow and reach to the underserved in a hassle-free manner and recent regulatory changes are testimony of the same. NABARD has been at the forefront of extending loans to microfinance institutions for last-mile engagement. The SHG Bank linkage programmes was also promoted by NABARD in early nineties, which took root in South first. Similarly, Tamil Nadu is one of the torch bearer of Mi crofinance movement in the country. All the three are actively involved with the conference.

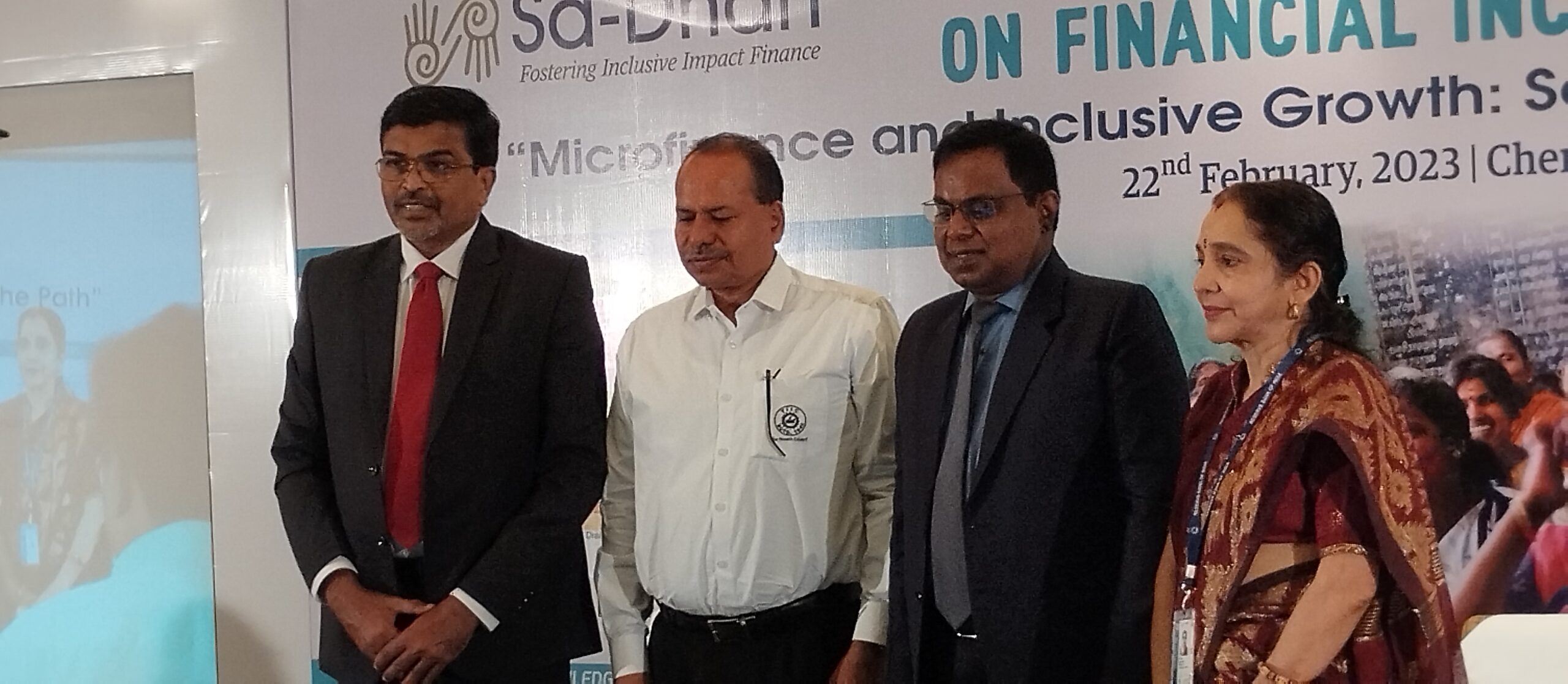

The conference will be inaugurated by Shaji KV, Chairman, NABARD, who will deliver the inaugural address at the conference. Hans Raj Verma, IAS, Additional Chief Secretary & CMD – of Tamil Nadu Industrial Investment Corporation (TIIC) will deliver Keynote address. Smt Uma Sankar CGM RBI will deliver special address.

The conference will have speakers like R S Isabella, CMD – Repco Microfinance Ltd, K Paul Thomas, MD & CEO – ESAF Small Finance Bank, P N Vasudevan, MD & CEO – Equitas Small Finance Bank, S Srimathy, Executive Dire c tor – Indian Overseas Bank, among other leading luminaires of the sector. The four sessions that will have a rob ust discussion on the microfinance industry and financial inclusion are – “Contribution of Microfinance in Finan cial Inclusion: Micro & Macro Perspectives,” “Facilitating Inclusive and Sustainable Growth,” “Innovations and Im pact in Financial Inclusion – Learning from the South,” and “Meeting the Funding Need: Opportunities & Cha lle nges.

About Sa-Dhan:

Sa-Dhan is an RBI recognized Self-Regulatory Organization (SRO) for Microfinance Institutions. Sa-Dhan is the oldest and largest association of community development finance institutions in India. It has been working for o ver two decades in supporting and strengthening the agenda of Financial Inclusion in India and creates a space and understanding of microfinance with policymakers, bankers, government, researchers, and practitioners. Sa-Dhan has 220 members reaching out to 33 states/UTs and 602 districts; it includes SHG promoting institutions, MFIs (For Profit and Not for Profit), banks, rating agencies, capacity building institutions etc. Sa-Dhan’s memb e rs follow diverse legal forms & operating models to reach out to approximately 44 million clients with loan outs tanding of more than ₹1,27,801 crores. Sa-Dhan is also recognized as National Support Organization (NSO) by National Rural Livelihood Mission (NRLM).